Facts About Tax Amnesty Meaning Uncovered

Wiki Article

Rumored Buzz on Tax Avoidance

Table of ContentsSome Known Facts About Tax Avoidance And Tax Evasion.The 45-Second Trick For TaxonomyTax - QuestionsWhat Does Taxonomy Do?Tax Avoidance for Beginners

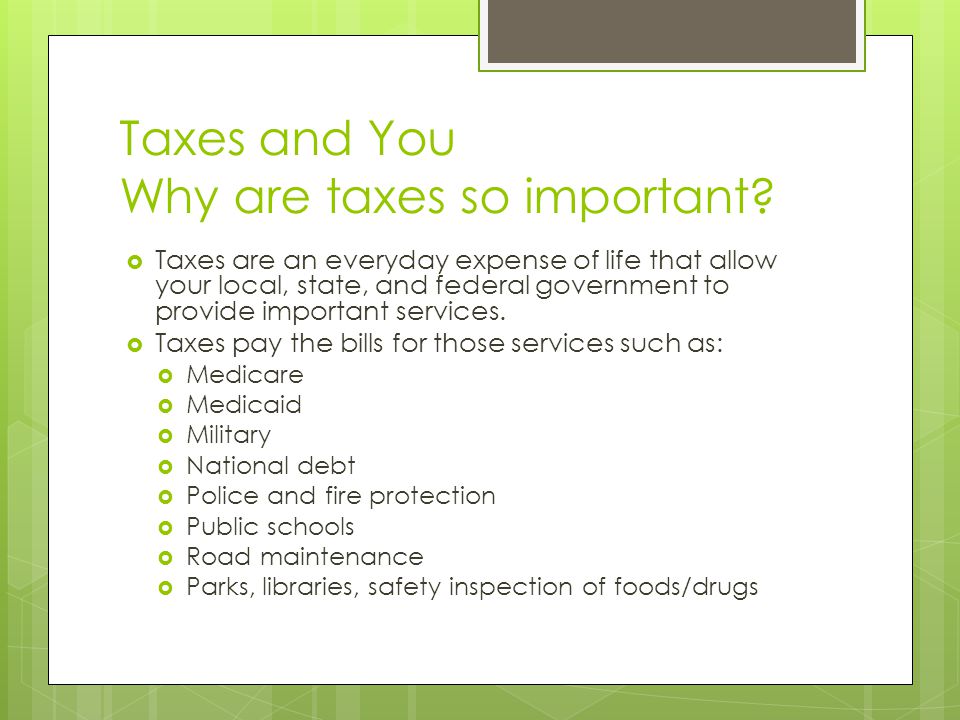

Governments impose charges on their residents and companies as a means of raising revenue, which is then made use of to meet their monetary needs. This includes funding government and public tasks in addition to making business atmosphere in the nation favorable for economic growth. Without taxes, federal governments would be not able to satisfy the needs of their societies.

Administration is a crucial part in the smooth running of country events. Poor governance would certainly have far reaching ramifications on the entire country with a heavy toll on its financial growth. Great administration makes certain that the money collected is used in a way that advantages citizens of the country. This cash likewise goes to pay public slaves, law enforcement officers, participants of parliaments, the postal system, as well as others.

In addition to social tasks, governments also make use of money collected from taxes to fund fields that are vital for the wellness of their residents such as safety, clinical research study, ecological defense, and so on. Several of the cash is also funnelled to fund jobs such as pensions, unemployment insurance, childcare, etc. Without tax obligations it would be impossible for federal governments to increase cash to money these kinds of jobs.

Top Guidelines Of Taxonomy

For service to prosper in the nation, there needs to be good infrastructure such as roadways, telephones, electrical power, and so on. This infrastructure is created by federal governments or via close involvement of the government. When federal governments collect cash from tax obligations, it ploughs this cash right into advancement of this infrastructure and also subsequently advertises economic task throughout the country.Tax obligations assist increase the criterion of living in a country. The greater the standard of living, the stronger as well as higher the level of usage most likely is. Companies grow when there is a market for their services and product. With a greater criterion of living, services would be ensured of a higher domestic usage also.

This is why it is essential that people endeavor to pay taxes as well as comprehend that it is meant to be more than simply a "cash grab" from the government. CPA Organization Consulting Structure Your Financial Success Value of Maintaining Track of Your Expenditures.

Tax Amnesty Meaning - An Overview

Note: the connections are significant at the 1% degree as well as stay substantial when controlling for revenue per capita. The amount of the tax obligation price for organizations issues for investment and also growth. Where taxes are high, organizations are a lot more inclined to pull out of the official field. A research shows that greater tax obligation prices are associated with less formal businesses and also lower private financial investment.Maintaining tax obligation prices at a reasonable degree can urge the growth of the exclusive sector and the formalization of companies. Enforcing high tax obligation prices on organizations of this dimension could not include much to federal government tax obligation income, however it could create services to move to the informal field or, also worse, cease operations.

The program reduced total tax costs by 8% and also added to a boost of 11. 6% in the company licensing price, a 6. 3% boost in the registration of microenterprises and a 7. 2% rise in the number of companies signed up with the tax authority. Earnings collections climbed by 7.

Economic advancement frequently raises the need for brand-new tax obligation income to fund climbing public expense. In establishing economies high tax obligation prices and weak tax management are not the only factors for reduced prices of tax obligation collection.

Getting The Tax Amnesty Meaning To Work

In Qatar as well as Saudi Arabia, it would need tax exemption philippines to make four settlements, still among the most affordable on the planet. In Estonia, adhering to revenue tax obligation, value included tax (VAT) and also labor tax obligations and also contributions takes just 50 hrs a year, around 6 working days. Research study finds that it takes a Doing Organization study firm longer usually to adhere to barrel than to comply with company income tax obligation.Research reveals that this is discussed by variants in management methods and also in how barrel is implemented. Conformity has a tendency to take less time in economic situations where the same tax obligation authority carries out barrel and company income tax. The usage of online declaring and repayment additionally considerably reduces compliance time. Regularity and also length of VAT returns likewise matter; needs to submit billings or other paperwork with the returns include in conformity time.

Commonly, the challenge of taxation begins after the tax return has actually been submitted. Postfiling processessuch as asserting a barrel reimbursement, undertaking a tax audit or appealing a tax assessmentcan additional hints be the most challenging interaction that a service has with a tax obligation authority. Services may have to invest more time and effort right into the procedures taking place after declaring of income tax return than right into the routine tax compliance procedures.

In concept, barrel's legal occurrence is on the final consumer, not on businesses. According to tax obligation policy guidelines set out by the Organisation for Economic Co-operation and also Growth (OECD), a barrel system ought to be neutral and efficient. The lack of a reliable barrel refund system for companies with an excess input barrel in an offered tax period will certainly threaten this goal.

Excitement About Tax Amnesty 2021

Hold-ups and inefficiencies in the barrel reimbursement systems are often the result of fears that the system may be mistreated as well as vulnerable to fraudulence.18 Relocated by this problem, many economies have established steps to moderate as well as limit the recourse to the barrel reimbursement system tax credit and also subject the reimbursement asserts to thorough step-by-step checks.The Working instance study firm, Taxpayer, Co., is a residential business that does not trade internationally. It performs a basic commercial and also business activity and it remains in its 2nd year of procedure. Taxpayer, Co. satisfies the VAT limit for enrollment as well as its regular monthly sales and regular monthly operating costs are repaired throughout the year, resulting in a favorable outcome VAT payable within each accounting duration.

Report this wiki page